Earnings Build; GDP Slows - November 1st, 2021

Weekly Market Newsletter

November 1st, 2021

A fresh wave of positive corporate earnings surprises sent markets to new record highs last week.

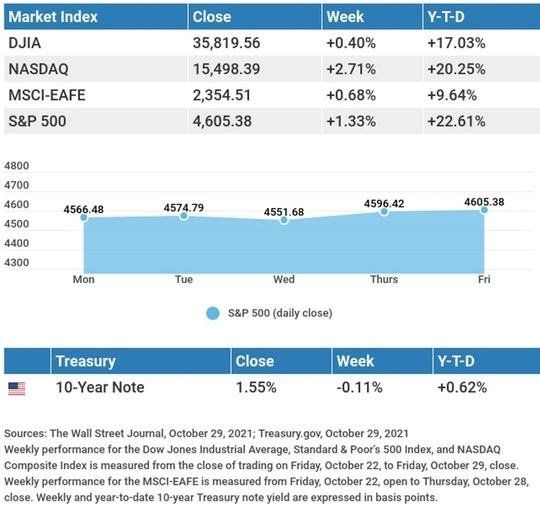

The Dow Jones Industrial Average increased 0.40%, while the Standard & Poor’s 500 rose 1.33%. The Nasdaq Composite index picked up 2.71% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, was up 0.68%.1,2,3

Investor Optimism Returns

After beginning the week on a lackluster note, stocks turned higher on Wednesday as companies kicked off a new earnings season and details about the Fed’s taper plans emerged. Investor enthusiasm shifted into high gear the following day on positive economic data and earnings reports that exceeded investor expectations. Buying continued through Friday on fresh earnings surprises and a better-than-expected retail sales report.

The economic data allayed some concerns about inflationary pressures and economic deceleration, while early earnings results provided hope that companies had weathered the surge in summer Covid infections.

Nevertheless, worries about how supply-chain disruption and higher prices may impact corporate earnings guidance haven’t gone away.

Let the Tapering Begin

Minutes from September’s Federal Open Market Committee released last week provided detail around the Fed’s plans to taper its $120 billion monthly bond purchase program. The Fed expects to reduce its purchases by $15 billion each month, beginning in mid-November/December and ending in June 2022.4

This tapering schedule is somewhat faster than what investors were anticipating, reflecting the Fed’s concern that inflation has been somewhat higher and more persistent than it had anticipated, with continuing supply-chain bottlenecks raising that risk level. Fed Chair Powell’s commitment to transparency and advanced signaling of policy changes appeared to have worked, as markets greeted the news calmly. In fact, stocks rallied strongly the following day as yields moved lower.

This Week: Key Economic Data

Monday: Industrial Production.

Tuesday: Housing Starts.

Thursday: Jobless Claims. Existing Home Sales. Index of Leading Economic Indicators.

Friday: PMI (Purchasing Managers’ Index) Composite Flash.

Source: Econoday, October 15, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: Netflix, Inc. (NFLX), Johnson & Johnson (JNJ), Procter & Gamble (PG), Kansas City Southern (KSU).

Wednesday: Tesla, Inc. (TSLA), International Business Machines (IBM), Verizon Communications (VZ), Abbott Laboratories (ABT), United Airlines (UAL), CSX Corporation (CSX).

Thursday: AT&T, Inc. (T), Intel Corporation (INTC), Snap, Inc. (SNAP), PPG Industries, Inc. (PPG), Southwest Airlines (LUV), American Airlines Group, Inc. (AAL), Union Pacific Corporation (UNP), Chipotle Mexican Grill, Inc. (CMG), Danaher Corporation (DHR), Dow, Inc. (DOW).

Friday: American Express Company (AXP), HCA Healthcare, Inc. (HCA), Schlumberger Limited (SLB).

Source: Zacks, October 15, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Tax Tip:

How to Research Tax-Exempt Organizations

The IRS makes it easy to check various organizations’ status to ensure that they are eligible to receive tax-deductible contributions. It provides a tool, Tax Exempt Organization Search, which allows users to research an organization quickly and easily, using information such as the organization’s name, Employee Identification Number, and location.

In addition to finding out whether an organization is eligible to receive tax-deductible donations, users also automatically can see whether any organizations’ tax-exempt status has been revoked (which happens if they don’t file their required Form 990-series for three years in a row), as well as access IRS determination letters that recognize the organization as tax-exempt, among other information.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional. Tip adapted from IRS.gov5

Footnotes and Sources

1. The Wall Street Journal, October 15, 2021

2. The Wall Street Journal, October 15, 2021

3. The Wall Street Journal, October 15, 2021

4. The Wall Street Journal, October 13, 2021

5. IRS.gov, February 26, 2021

We would love to answer any questions you may have. Please contact us at:

248-641-9200

Rochester Hills Office

305 Barclay Circle Suite 1002

Rochester Hills, MI 48307

Phone: (248) 641-9200

Fax: (248) 641-9204

Toll-Free: (866) 869-9777

Mon-Fri: 9:00 AM - 5:00 PM

Sat-Sun: By Appointment

Solutions

BENEFINANCIAL GROUP

We are an independent insurance agency helping individuals create retirement strategies using a variety of insurance products to custom suit their needs and objectives. *Any references to protection benefits or steady and reliable income streams on this website refer only to fixed insurance products. They do not refer, in any way, to securities or investment advisory products. Annuity guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Annuities are insurance products that may be subject to fees, surrender charges and holding periods which vary by insurance company. Annuities are not FDIC insured. The information and opinions contained in any of the material requested from this website are provided by third parties and have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. They are given for informational purposes only and are not a solicitation to buy or sell any of the products mentioned. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual's situation.

Guarantees provided by insurance products are backed by the claims paying ability of the issuing carrier. BeneFinancial Group and the Insurance and/or Investments they offer are separate entities. Insurance products and services are offered and sold through individually licensed and appointed agents in all appropriate jurisdictions under BeneFinancial Group. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or insurance strategies. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Licensed to sell insurance in the following States: AZ, CA, FL, GA, MI, SC, & TX.

WARRANTIES & DISCLAIMERS

There are no warranties implied. Clear Strategy is an IAR Firm through their broker dealer Osaic Wealth, this branch office is located in Rochester Hills, Michigan. Clear Strategy may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Clear Strategy’s web site (link from BeneFinancial Group) is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Clear Strategy’s’ web site on the Internet should not be construed by any consumer and/or prospective client as Clear Strategy’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Clear Strategy’s Advisors with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Clear Strategy’s Advisors / Osaic Wealth, please contact the state securities regulators for those states in which Clear Strategy’s Advisors / Osaic Wealth maintains a registration filing. A copy of Clear Strategy’s Advisors’ current written disclosure statement discussing Clear Strategy’s Advisors’ / Osaic Wealth business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from Clear Strategy’s Advisors upon written request. Please make sure to check with your states insurance bureau and FINRA for representative and agent licensing, complaints, and background. www.finra.org and www.michigan.gov/difs. Clear Strategy’s Advisors / Osaic Wealth does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Clear Strategy’s Advisors’ web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Securities and investment advisory services are offered through the firms: Osaic Wealth, Inc., Triad Advisors, LLC, Osaic Institutions, Inc., and Woodbury Financial Services, Inc., broker-dealers, registered investment advisers, and members of FINRA and SIPC. Securities are offered through Securities America, Inc., American Portfolios Financial Services, Inc., and Ladenburg Thalmann & Co., broker-dealers and member of FINRA and SIPC. Advisory services are offered through Arbor Point Advisors, LLC, American Portfolios Advisors, Inc., Ladenburg Thalmann Asset Management, Inc., Securities America Advisors, Inc., and Triad Hybrid Solutions, LLC, registered investment advisers. Advisory programs offered by Osaic Wealth, Inc., Securities America Advisors, Inc., Triad Advisors, LLC., and Woodbury Financial Services, Inc., are sponsored by Vision2020 Wealth Management Corp., an affiliated registered investment adviser. 5762464

The website and information are provided for guidance and information purposes only. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. The website and information are not intended to provide investment, tax, or legal advice.

To the extent that any client or prospective client utilizes any economic calculator or similar device contained within or linked to Bene Financial Group’s web site, the client and/or prospective client acknowledges and understands that the information resulting from the use of any such calculator/device, is not, and should not be construed, in any manner whatsoever, as the receipt of, or a substitute for, personalized individual advice from Clear Strategy, or from any other investment professional.

Insurance products and services are offered and sold through BeneFinancial Group and individually licensed and appointed insurance agents. Securities offered through Osaic Wealth member FINRA/SIPC. Osaic wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

CARE DISCLOSURE

We have made recommendation(s) using reasonable diligence, care, and skill in the following ways: Know the consumer’s financial situation, insurance needs, and financial objectives. Understanding the available recommendation(s) options after making a reasonable inquiry into options available to the producer(s). Having the basis to believe the recommended option effectively addresses the consumers financial situation, insurance/investment needs, and financial objectives over the life of the product, as evaluated in light of the consumer profile information. A consumer profile was completed during application. Standard information including, insurance needs, resources to fund product, existing assets, risk tolerance, and their financial situation. For exchanges/replacements, considerations have been surrender charges, loss of potential benefits, costs, fees, exchanges within sixty-months, and the benefit of replacing/exchanging from old to new product.

CONFLICT OF INTEREST DISCLOSURE

Insurance products sold through BeneFinancial Group (BFG) and its representatives may earn BFG and/or its representative commissions. Investments and products sold through Clear Strategy and Osaic Wealth may also earn the representative commissions and/or fees regarding securities and financial planning. You as the consumer, client, purchaser, have the right to seek out any individual, firm, and/or entity when purchasing insurance and/or securities. You DO NOT have to purchase any insurance and/or security from BeneFinancial Group and/or Clear Strategy / Osaic Wealth if purchasing/paying for a financial plan. I/We understand that insurance and any purchases thereof are provided by BeneFinancial Group. Any securities transactions, planning, and/or fees are sold through Osaic Wealth & Clear Strategy and their representatives. BeneFinancial Group, Clear Strategy, and Osaic Wealth are not related companies.

DOCUMENTATION OBLIGATION

Requires producers to make a written record of any recommendation and the basis for the recommendation.

DISCLOSURE OBLIGATION

Please be advised that the following has been explained, described, completed, and discussed. Relationship with client, roles of producers (insurance, securities, legal, accounting, etc..), companies and products the producer is licensed to sell/promote. Producers are licensed/offered to sell/promote multiple companies/carriers. They may from time to time use a few of these companies dependent on business, service, offering’s specific to client needs. Producers are paid by fees, commissions, and non-cash compensation through insurance carriers and/or broker dealer/securities. You have the right to request additional information on cash compensation. The Managing Partners of BeneFinancial Group provide/transact insurance business. Mr. Pipkens and Mr. Schroder provide/transact security advice/business through Osaic Wealth, a broker dealer. Member FINRA/SIPC. BeneFinancial Group and Osaic Wealth are unrelated companies.

ROLLOVER DISCLOSURE

The decision to rollover a qualified account should NOT happen until all options have been reviewed. Each option may or may not be suitable for an investor/client. Your representative has provided the following information:

Can you keep your account at your employer should you leave/retire?

Have the costs to stay or “rollover” been discussed/compared?

Can you rollover former employer plan monies into your new company’s plan?

Potential taxation and penalties if assets are withdrawn, both before age 59 ½ and after?

After tax monies from qualified plans may be affected if rolled into IRA’s?

Stock ownership inside a qualified plan may be forfeited by a rollover into another qualified account?

SMS / EMAIL OPT OUT POLICY / TERMS OF AGREEMENT / PRIVACY POLICYLast updated: 01/03/2024

BeneFinancial Group (“Pezzillo Financial Group, Inc., “we”, or “us”) operates a mobile messaging program (the “Program”) subject to these Mobile Messaging Terms and Conditions (these “Mobile Messaging Terms”). The Program and our collection and use of your personal

information is also subject to our Privacy Policy. By enrolling, signing up, or otherwise agreeing to participate in the Program, you accept and agree to these Mobile Messaging Terms and our Privacy Policy.

1. Program Description: We may send promotional and transactional mobile messages in various formats through the Program. Promotional messages advertise and promote our products and services and may include [promotions, specials, other marketing offers, and

abandoned checkout reminders]. Transactional messages relate to an existing or ongoing transaction and may include [order notifications and updates, appointment reminders, and other transaction-related information]. Mobile messages may be sent using an automated technology, including an autodialer, automated system, or automatic telephone dialing system. Message frequency will vary [but will not exceed x messages per x]. You agree that we, our affiliates, and any third-party service providers may send you messages regarding the foregoing topics or any topic and that such messages and/or calls may be made or placed using different telephone numbers or short codes. We do not charge for mobile messages sent through the Program but you are responsible for any message and data rates imposed by your mobile provider, as standard data and message rates may apply for short message service and multimedia message alerts. 2. User Opt-In: By providing your mobile phone number to us, you are voluntarily opting in to the Program and you agree to receive recurring mobile messages from us at the mobile phone number associated with your opt-in, even if such number is registered on any state or federal “Do Not Call” list. You agree that any mobile phone number you provide to us is a valid mobile phone number of which you are the owner or authorized user. If you change your mobile phone number or are no longer the owner or authorized user of the mobile

phone number, you agree to promptly notify us at info@benefingroup.com. Your participation in the Program is not required to make any purchase from us and your participation in the Program is completely voluntary.

3. User Opt-Out and Support: You may opt-out of the Program at any time. If you wish to opt-out of the Program and stop receiving mobile messages from us, or you no longer agree to these Mobile Messaging Terms, reply STOP, QUIT, CANCEL, OPT-OUT, and/or UNSUBSCRIBE to any mobile message from us. You may continue to receive text messages for a short period while we process your request and you may receive a one-time opt-out confirmation message. You understand and agree that the foregoing is the only reasonable method of opting out. If you want to join the Program again, just sign up as you did the first time, and we will start sending messages to you again. For support, reply HELP to any mobile message from us.

Our mobile messaging platform may not recognize requests that modify the foregoing commands, and you agree that we and our service providers will not be liable for failing to honor requests that do not comply with the requirements in these Mobile Messaging Terms. We may also change the telephone number or short code we use to operate the Program and we will notify you of any such change. You acknowledge that any requests sent to a

telephone number or short code that has been changed may not be received by us and we will not be responsible for failing to honor a request sent to a telephone number or short code that has been changed.

4. Disclaimer of Warranty and Liability: The Program is offered on an “as-is” basis and may not be available in all areas, at all times, or on all mobile providers. You agree that neither we nor our service providers will be liable for any failed, delayed, or misdirected delivery of any mobile message or information sent through the Program.

5. Modifications: We may modify or cancel the Program or any of its features at any time, with or without notice. To the extent permitted by applicable law, we may also modify these Mobile Messaging Terms at any time. Any such modification will take effect when it is posted to our website. You agree to review these Mobile Messaging Terms periodically to ensure that you are aware of any modifications. Your continued participation in the Program will

constitute your acceptance of those modifications.

This Privacy Policy explains how Pezzillo Financial Services, Inc. and BeneFinancial Group (DBA) collects, uses and discloses personal information of its customers, prospective customers, and visitors to its website at www.benefingroup.com.

COLLECTION OF PERSONAL INFORMATION

Information collected directly from you: We may collect personal information directly from you, for example [through a web form, during an online or in-person registration, while making a reservation, while setting up an account with us, or when you contact us for customer support. Personal information we collect directly from you may include first and last name, address, email address, and phone number.

Information collected from your device: Our website may use tracking technologies such as cookies, web beacons, pixels, and other similar technologies to automatically collect certain information from your device, including for example your IP address, browser and operating system information, geographic location, referring website address, and other information about how you interact with the website. Our website may also use cookies to personalize your experience and enable certain features. however, disable cookies in your web browser however, parts of our website may not function properly. More information about blocking and deleting cookies is available at http://www.allaboutcookies.org. Our email campaigns may also use tracking technologies such as web beacons, pixels and other similar technologies to automatically collect certain information such as your IP address, browser type and version, and email engagement statistics.

Information collected from our advertising partners: We may collect personal information about you from our advertising partners. Personal information we collect from our advertising partners may include [your demographic information and geographic location.

USE OF PERSONAL INFORMATION

We use information collected directly from you to provide you with our products and services, customer service and support, and other relevant information. We may also use this information to market our products and services to you, including by email and text message subject to your consent.

We use information collected automatically from your device to provide our website to you, to optimize our website, and to assist with our marketing efforts.

We may also use information collected from you and information collected from your device to send you abandoned cart reminders if you added items to your shopping cart but did not complete check out.

We use information collected from our advertising partners to market our products and services to you.

DISCLOSURE OF PERSONAL INFORMATION

We may use third-party service providers to assist us with providing and marketing our products and services to you and we may share your information with such third parties for these limited purposes.

● We use Constant Contact for our email marketing and text message communications. For more information about how we may use your information with Constant Contact and the information that may be collected through our email campaigns, see Constant Contact’s Customer Data Notice available at https://www.constantcontact.com/legal/customer-contact-data-notice.

● We use ModInteractive to help us understand how visitors interact with our website. ModInteractive uses and processes your information in accordance with its privacy policy available at ModInteractive’s privacy policy.

We may also share your personal information if necessary to comply with applicable laws and regulations, to respond to a subpoena, search warrant or other lawful request for information we receive, or to otherwise protect our rights.

EMAIL AND TEXT MESSAGE COMMUNICATIONS

If you wish to unsubscribe from our email campaigns, please click on the Unsubscribe link at the bottom of any marketing email sent from us.

You may have the right to request access to the personal information we hold about you, to port it to a new service, or to request that your personal information be corrected or deleted. To exercise any of these rights, please contact us at 866-869-9997 or info@benefingroup.com

CHANGES TO THE THIS PRIVACY POLICY

We may update this Privacy Policy at any time. Please review it frequently.

CONTACT INFORMATION

If you have any questions about this policy or our privacy practices, please contact us at 866-869-9997 or info@benefingroup.com.

LEGACY LOCK DISCLOSURE

BeneFinancial Group and/or its associates are NOT attorneys. We do not and cannot give legal advice should you purchase an estate plan through Legacy Lock. We are coordinators and gather information that you provide. Once collected we forward to Legacy Lock, where a state certified/appointed licensed attorney completes your trusts/wills.

Licensed to sell insurance in the following States: AZ, CA, FL, GA, MI, SC, MO, & TX.

All Rights Reserved | BeneFinancial Group